Jump to

Credit Quality

Our Credit Profile provides a quantitative snapshot of our credit quality and the strength of Temasek’s financial position.

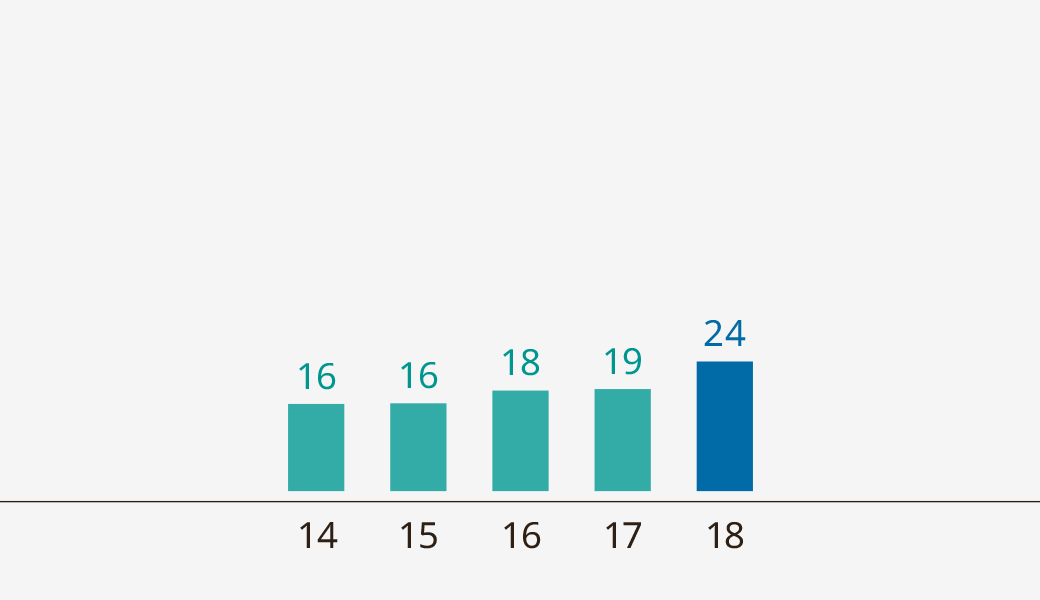

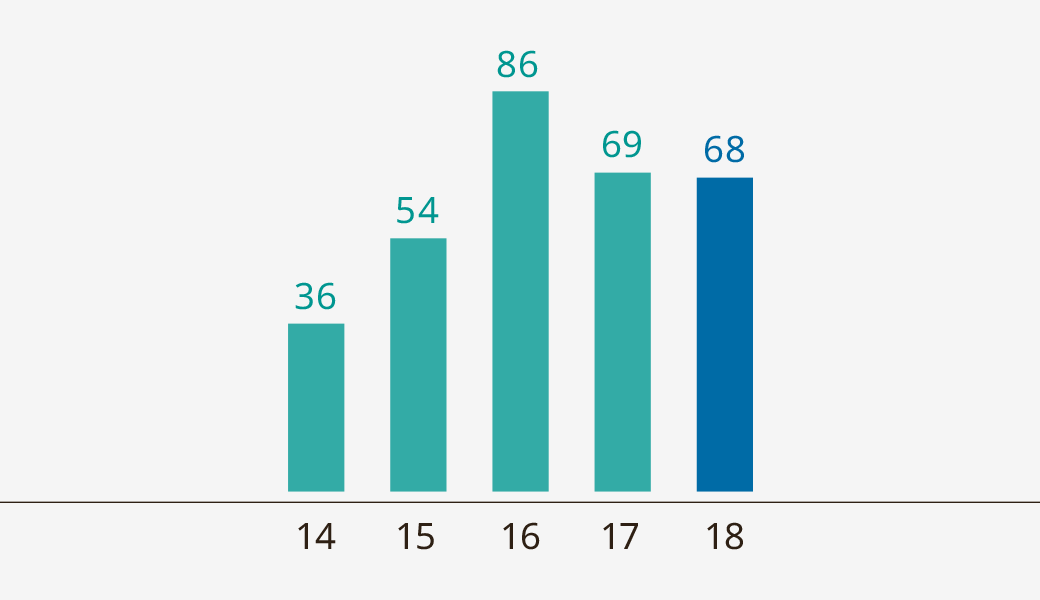

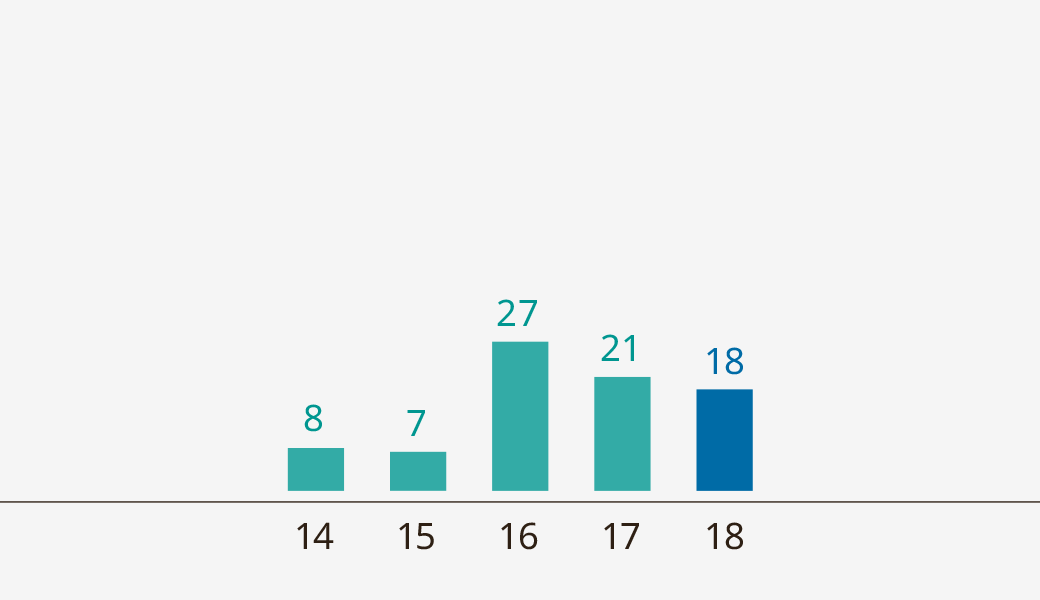

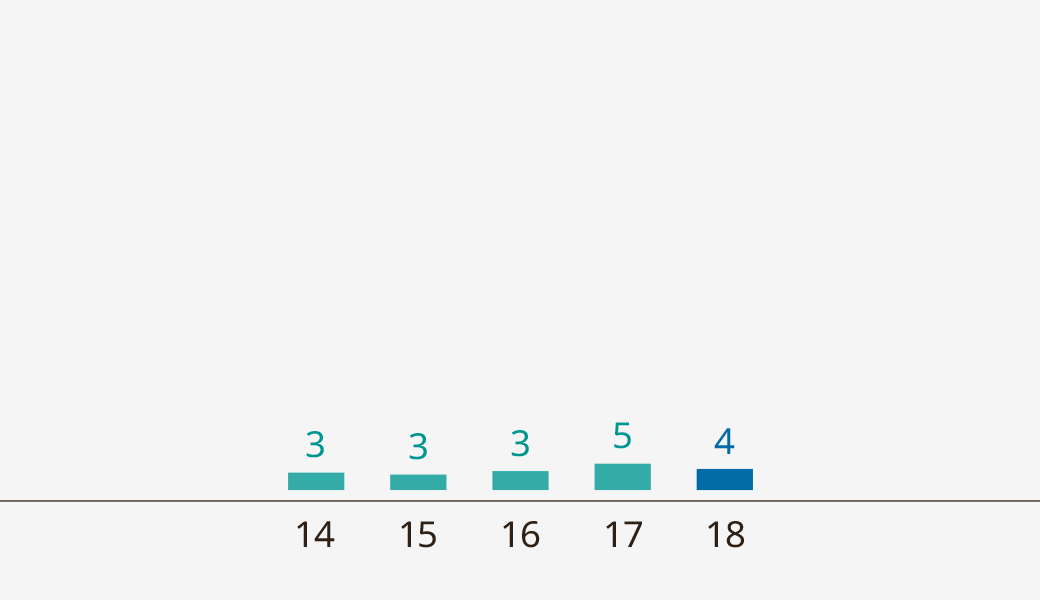

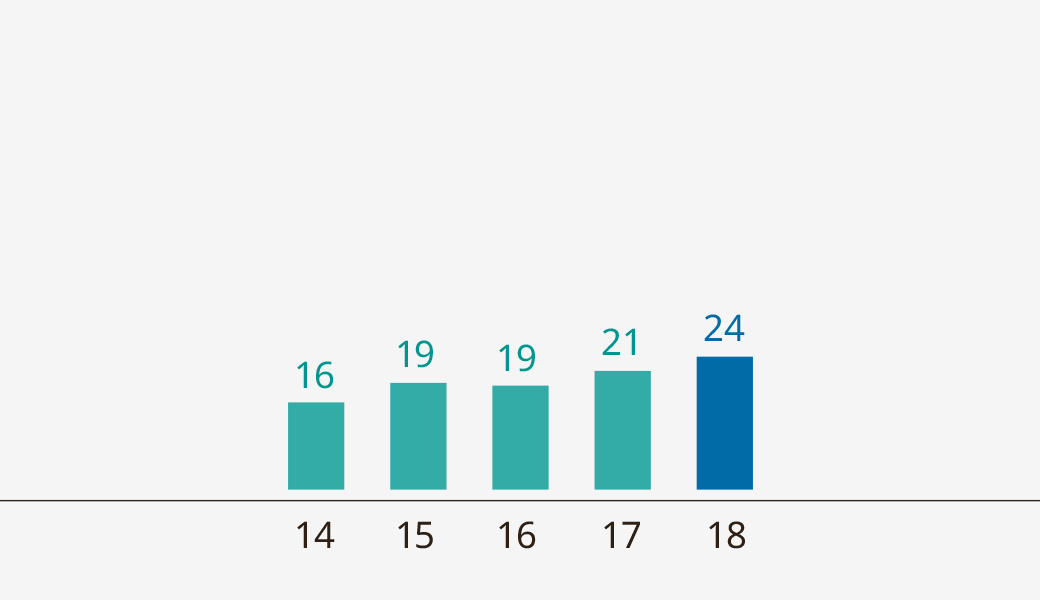

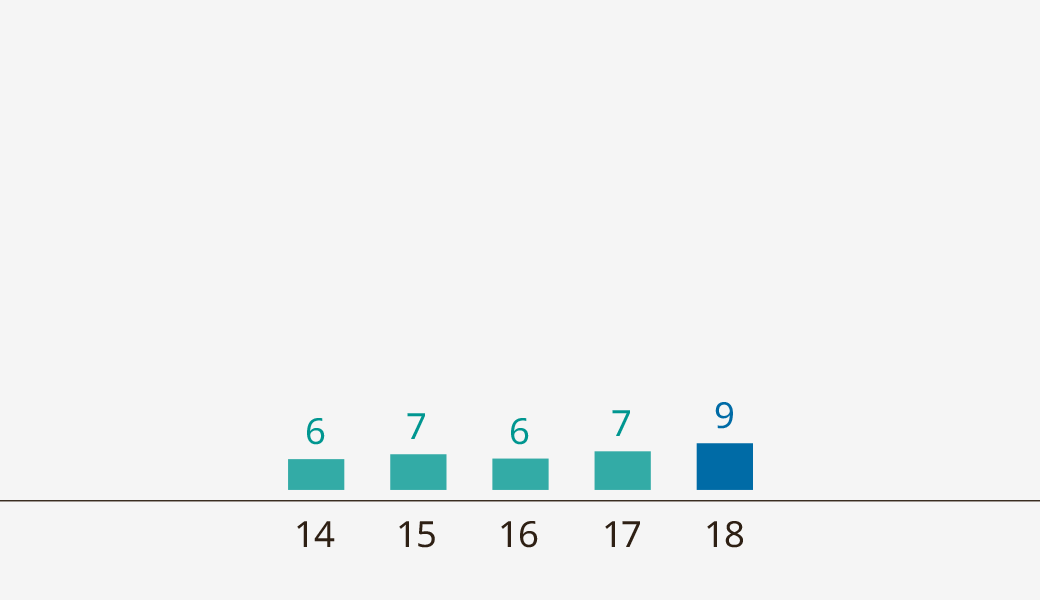

(for year ended 31 March)

Dividend Income

over Interest Expense (×)

24x

Recurring Income

over Interest Expense (×)

68x

Recurring Income

over Total Debt due in One Year (×)

18x

Liquidity Balance

over Total Debt due in next 10 Years (×)

4x

Net Portfolio Value

over Total Debt (×)

24x

Liquid Assets

over Total Debt (×)

9x

As an investment company, our dividend income and divestment proceeds are used to pay our business expenses, interest to bond investors, dividends to our shareholder; repay bonds which are due; and make investments.

For the year ended 31 March 2018, Temasek earned S$9 billion in dividend income and divested S$16 billion. These amounts formed the bulk of our cash inflows.

Unlike pension funds or oil funds, we do not have inflows from pension savings or oil revenues.

Our dividend income for the year ended 31 March 2018 was about 24 times our interest expense.

Temasek had S$12.8 billion of debt outstanding as at 31 March 2018, with S$8.5 billion due within the next 10 years.

Temasek’s cash and cash equivalents, plus short term investments, as at 31 March 2018, were four times our S$8.5 billion debt due within the next 10 years.

Key Credit Parameters (in S$ billion)

| For year ended 31 March | 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|

| Divestments | 10 | 19 | 28 | 18 | 16 |

| Dividend income | 7.9 | 7.9 | 7.8 | 7.0 | 9.0 |

| Income from investments | 0.1 | 0.1 | 0.2 | 0.2 | 0.3 |

| Interest income | 0.1 | 0.1 | 0.2 | 0.2 | 0.2 |

| Interest expense | 0.5 | 0.5 | 0.4 | 0.4 | 0.4 |

| Net portfolio value | 223 | 266 | 242 | 275 | 308 |

| Liquid assets | 80.3 | 90.6 | 74.3 | 91.1 | 110.3 |

| Liquidity balance | 29.9 | 26.7 | 27.1 | 37.6 | 33.2 |

| Total debt | 14.2 | 13.8 | 12.9 | 12.8 | 12.8 |