Financial Discipline

We are governed by a set of stringent financial

policies and disciplines.

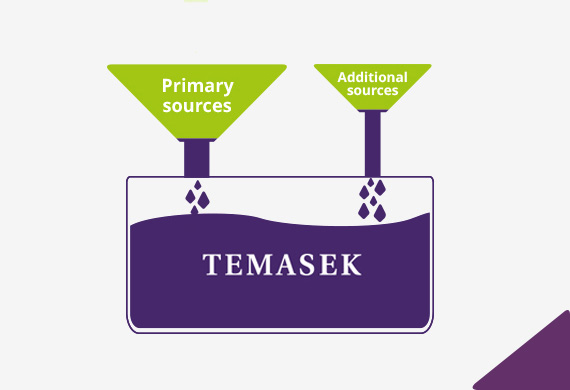

We manage our leverage, liquidity, and balance sheet

prudently for resilience and flexibility, even in

times of extreme stress. We ensure that our primary

sources of cash flows can cover our

non-discretionary expenses, such as operating

expenses, interest to bondholders, and debt

repayments.

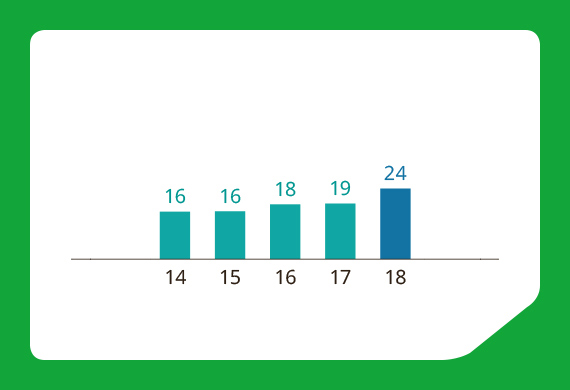

Our Board sets our overall debt limit, taking into

account our shareholder funds, cash flow and credit

profile.

Capital and Liquidity Management

Our primary sources of funds include divestment

proceeds, as well as dividends and distributions

received from our portfolio. These are supplemented

by our Temasek Bonds and Euro-commercial Paper.

We plan proactively for a long dated and well

distributed debt maturity profile, and avoid a large

debt tower in any one year.

Liability Management

Temasek does not issue any financial guarantees for

our portfolio companies’ obligations.

Foreign Exchange Management

Our projected risk-adjusted return for each

investment proposal needs to also cover foreign

exchange (FX) risk. Where appropriate, we close up

our FX exposure using the relevant FX instruments.