Jump to

Long Term Alignment

Our ownership ethos puts the institution above the individual, emphasises long term over short term, and aligns employee and shareholder interests over economic cycles.

Our compensation framework aims to foster a high performing and responsible culture where our employees think and act as owners, sharing gains and pains alongside our shareholder. It balances reward for short term performance and long term value creation.

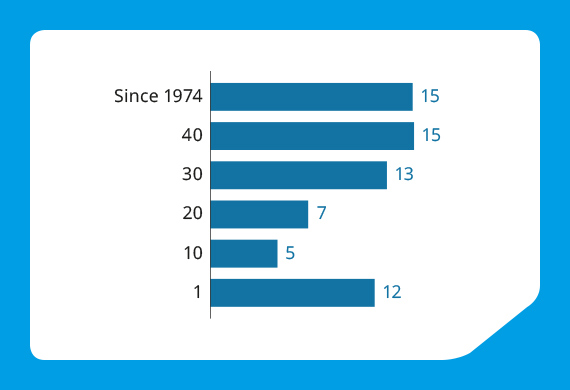

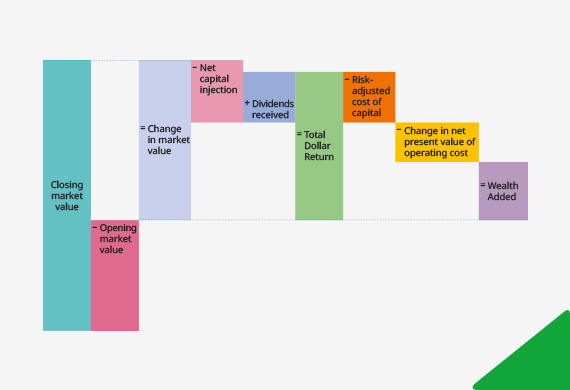

Our base salaries are benchmarked against relevant markets where we compete for talent. Short term bonuses are driven by annual targets. Returns above our risk-adjusted cost of capital determine our Wealth Added (WA) incentive pool, while negative returns determine our clawback pool. Deferred incentives and clawbacks are integral to our remuneration. Longer term incentives can be deferred up to 12 years and subject to market risks and clawbacks, to account for sustainability of returns over market cycles.

Annual Cash Bonuses – Our Short Term Incentives

Annual cash bonuses are driven by company-wide, team and individual performances, and capped within budgeted limits. One of our annual performance targets requires our three-year Total Shareholder Return (TSR) to exceed our three-year cost of long term debt.

Apart from financial targets, our “Make-A-Difference” (MAD) Programme rewards employees for achieving non-financial goals targeted at strengthening the institution, contributing to our community, and taking care of our families and ourselves.

WA Bonus Bank – Our Medium Term Incentives

A portion of our WA incentive pool, whether positive or negative, is distributed into each employee’s notional WA bonus bank account, based on the individual’s performance and contributions over four years.

If WA bonus bank balances are positive, senior management receive payouts of no more than a third of their balances. Payouts are half for mid-level management and two thirds for other employees.

Part of the retained balances are deferred as co-investment (R-Scope) grants which vest over the following three years. The remaining WA bonus bank balances are subject to clawbacks in the future should returns be negative.

Co-ownership Grants – Our Long Term Incentives

Our employees may be awarded co-investment grants with performance or time-based vesting conditions. These units grow or decline in value with our yearly TSR, reinforcing the ownership culture of our company. Co-investment units lapse after 12 years.

Part of our positive WA incentive pool funds the Temasek co-investment (T-Scope) grants, which have stringent multi-year Temasek portfolio performance conditions to trigger a five-year vesting. Another portion is held for three to seven years, as a company-wide reserve to be released progressively for time-based co-investment grants. Clawbacks, if any, will first be taken from this company-wide reserve, before being deducted from employees’ WA bonus bank accounts.

Deferred incentives and clawbacks are integral to our remuneration.

Our annual operating budget funds limited time-based co-investment (S-Scope) grants, which vest over five years, starting in the third year from the grants’ commencement.

Co-ownership Alignment in Practice

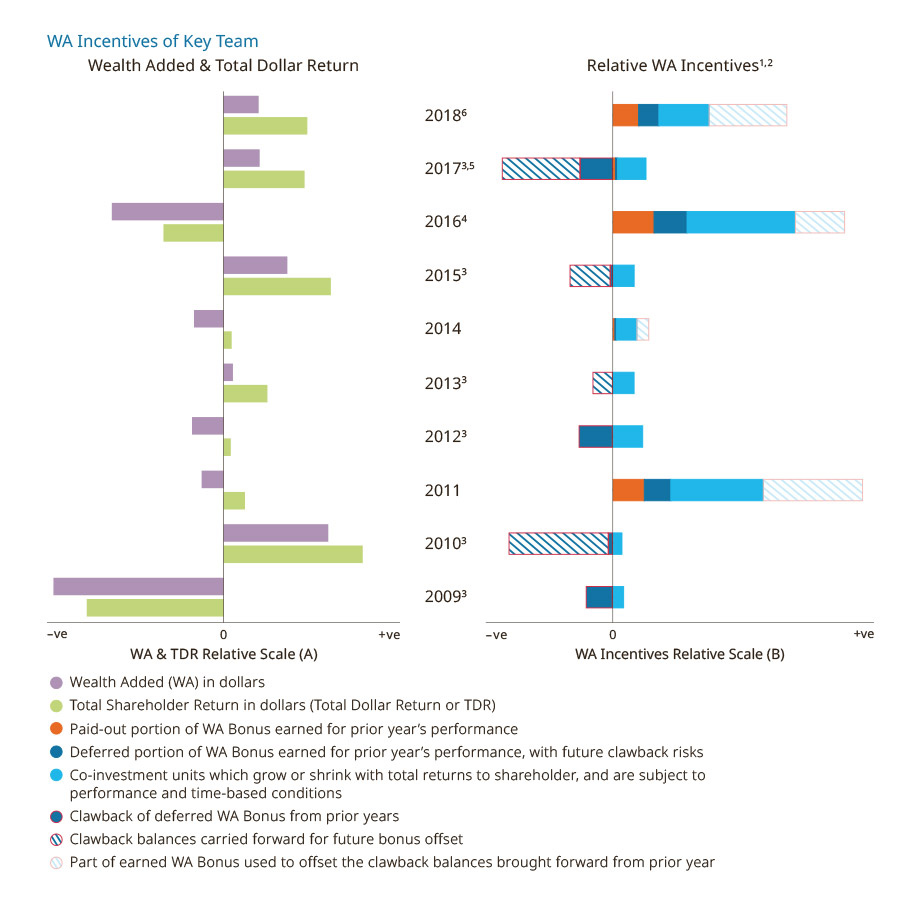

In the last decade, we had six clawback pools when Wealth Added (WA) for prior years was negative. Out of these six, there were four instances we had to carry forward clawback balances, because the deferred WA incentives were insufficient to clear the clawback pools from prior years.

The positive WA for the year ended 31 March 2017 allowed us to make good the balance clawback pool carried over from the previous year, with a balance for distribution to our employees.

The positive WA of S$14.0 billion for the year ended 31 March 2018 will enable us to continue to share our successes with our employees, as well as the wider community.

Incentives can be deferred up to 12 years and subject to market risks and clawbacks.

This demanding framework for sharing gains and the associated risks and pains through market cycles has been tested, thereby reaffirming our ownership ethos.

(for year ended 31 March)

Chart footnotes