Jump to

An Active Investor

We build for the future, as an active investor and owner, investing for this and future generations.

We have evolved since our inception – from investing mostly in Singapore, then to Asia, and now in Europe and the Americas as well. The latter two now form almost a quarter of our underlying exposure.

Our investment philosophy has remained unchanged over the last 16 years, disciplined and guided by four investment themes:

- Transforming Economies

- Growing Middle Income Populations

- Deepening Comparative Advantages

- Emerging Champions

We are starting to invest into several secular trends in recent years:

- Longer Lifespans

- Rising Affluence

- Sustainable Living

- Smarter Systems

- Sharing Economy

- More Connected World

This defines the directional shape of our portfolio. Driven by technological advances, demographic shifts, and changing consumption patterns, these trends may rapidly disrupt old business models, or create new experiences or communities. They underpin hopes and opportunities for a better, smarter and more connected world.

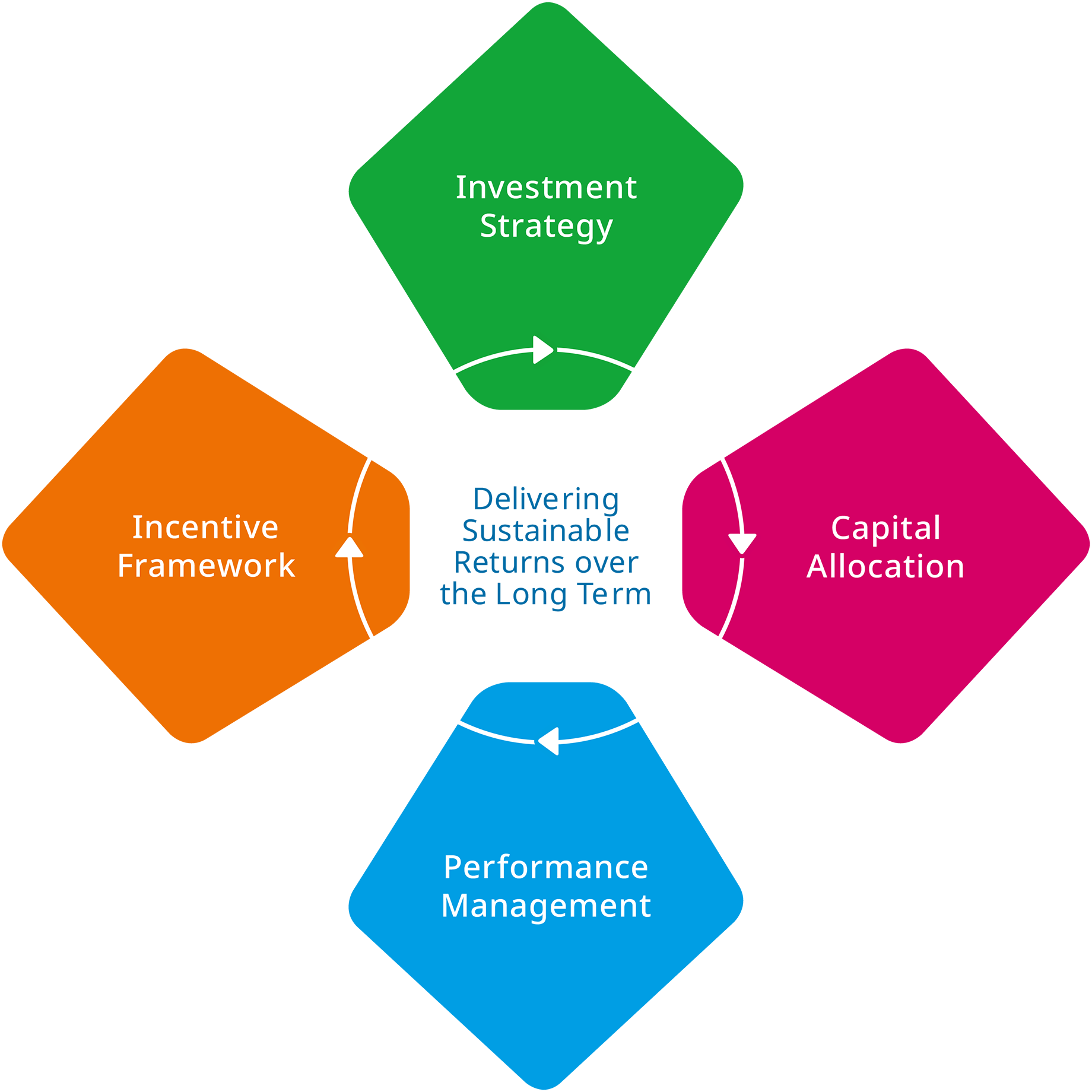

Our investment discipline focuses on intrinsic value and our risk-return framework. We are driven by bottom-up intrinsic value tests for each opportunity, with returns tracked against a risk-adjusted cost of capital. This risk-return framework drives our investment strategy, capital allocation, performance measurement and incentive system.

We manage our liquidity and balance sheet for resilience.

This framework also guides us as we strive to be an enabler across all stages of enterprise growth, from early stage companies to mature businesses. We seek out disruptive business models that can transform industries and uplift growth.

We have full flexibility as an owner and investor to reshape and rebalance our portfolio, whenever opportunities or challenges arise. We are mostly invested in equities, based on our risk-return appetite, investing or divesting in line with our outlook and value tests. We may take concentrated positions or remain in cash, and do not set limits for asset classes, countries or sectors. We manage our liquidity and balance sheet for resilience.

We are an active shareholder, seeking to add or create value in our portfolio. We share our perspectives on global or strategic trends frequently with partners, and the boards and management of our portfolio companies. We proactively promote good governance, looking to boards to drive strategy and oversee management, who, in turn, run their respective companies.

Our investment discipline focuses on intrinsic value and our risk-return framework.

We invest across all stages of a business life cycle, from startup to listed. In aggregate since 2002, our unlisted assets have delivered better returns than our listed investments.

Our unlisted assets comprise companies and funds. Our unlisted blue chip companies, such as PSA and Mapletree, and our portfolio of high quality funds, pay steady dividends and distributions. Our investments in funds have been instrumental in helping us gain deeper insights into new markets and have provided co-investment opportunities.

From time to time, we may express our interest to invest or divest selected positions or manage our portfolio through options and warrants. We may also use derivatives to hedge currency and/or protect against potential losses of our underlying investments, where gains and losses of the derivatives are matched against corresponding losses and gains in the underlying investments.