Jump to

Investing in Bonds

From time to time, a company, organisation or government may issue bonds. This is a way to borrow money directly from investors via the bond markets. In return, the issuer pays its bondholders a ‘coupon’ – an interest rate on the principal sum they have lent to the issuer through the bonds.

When the bond matures at the end of the tenor or borrowing period, bond investors expect to be repaid the principal sum that they had invested or lent upfront.

In general, the stronger the credit quality of the issuer, the lower the coupon of the bond issued. Bond investors should assess the credit quality of the bond issuer based on its credit profile.

All investments carry risks. Investors need to understand the risks and balance them against their desire to earn higher returns. The key risks for bond investors include default risk, interest rate risk, liquidity risk and inflation risk.

Default risk

A bond issuer may be unable to pay interest due or repay the principal sum.

For example, an issuer may have cash flow problems, or in the worst case, may be facing bankruptcy.

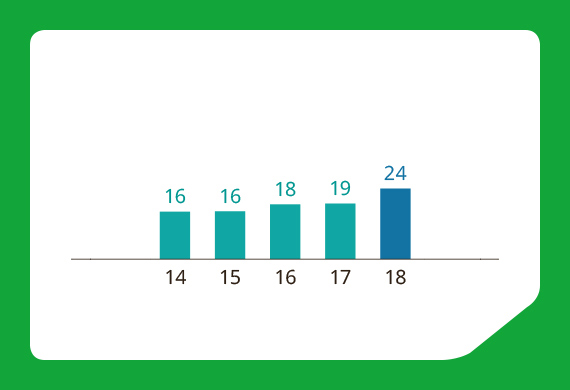

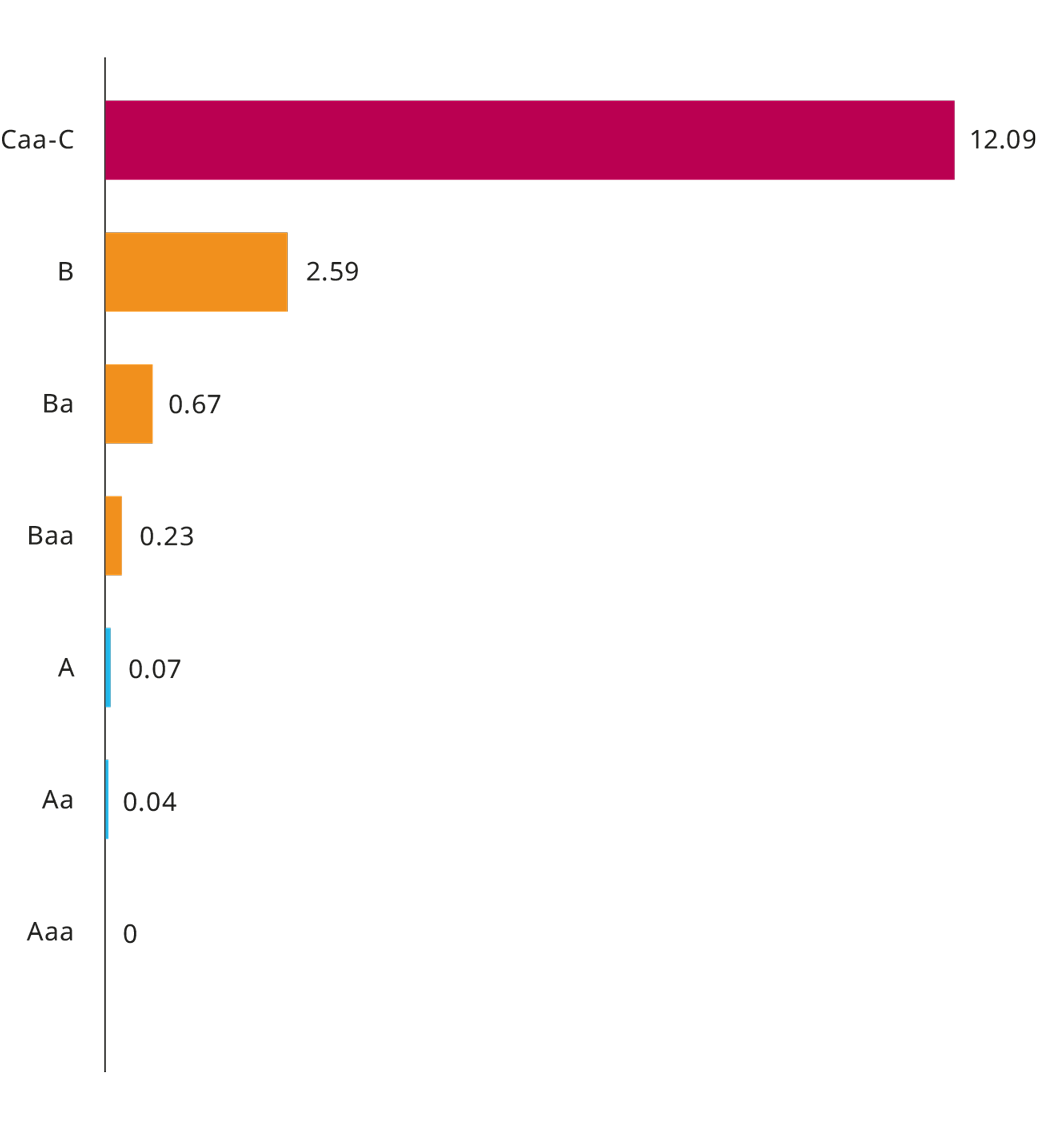

Data shows that the higher the rating, the lower the observed frequency of default, and vice versa. The chart below shows the average annual corporate default rates in the last 20 years.

Average Annual Corporate Default Rates: 1998 – 2017 (%)

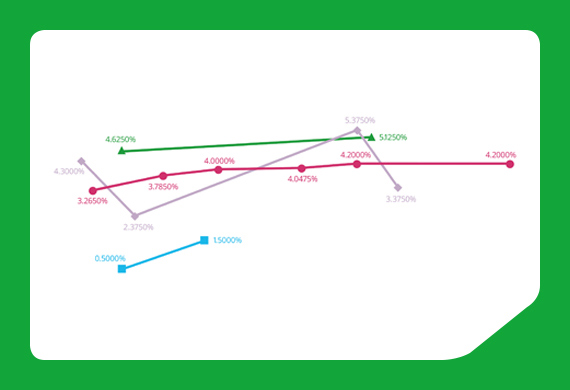

Interest rate risk

Interest rates may change and affect the market value of a bond, compared to its face value.

For example, if interest rates rise, bond prices will likely fall. Investors could make a loss if they need to sell their bonds before maturity.

Liquidity risk

Sometimes, an investor may not be able to find a buyer for his or her bonds.

For example, some bonds may be traded infrequently. Someone wishing to sell urgently may have to sell at unattractive low prices, at a lower profit or at a loss.

Inflation risk

The coupon payments plus principal sum repayment of a bond may not keep pace with inflation.

For example, when inflation increases, the fixed coupon payment would be worth less.