Jump to

20-year Returns Outlook

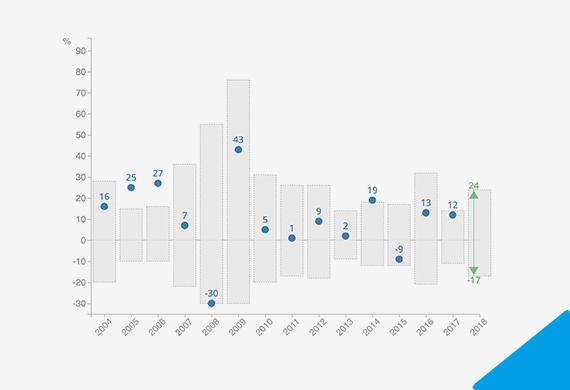

Our T-GEM, or Temasek Geometric Expected Return Model, simulates the range of possible returns for our portfolio over the next 20 years. These simulations are not predictive of actual outcomes.

Economic Scenario-Based Approach

As equity returns are volatile over time, and influenced by macroeconomic or geopolitical events, T-GEM uses a scenario-based approach to simulate our 20-year long term expected returns. This approach takes into account our views of long term macroeconomic fundamentals over the next 20 years, adjusted for current market valuations.

Projection Based on Economic Fundamentals

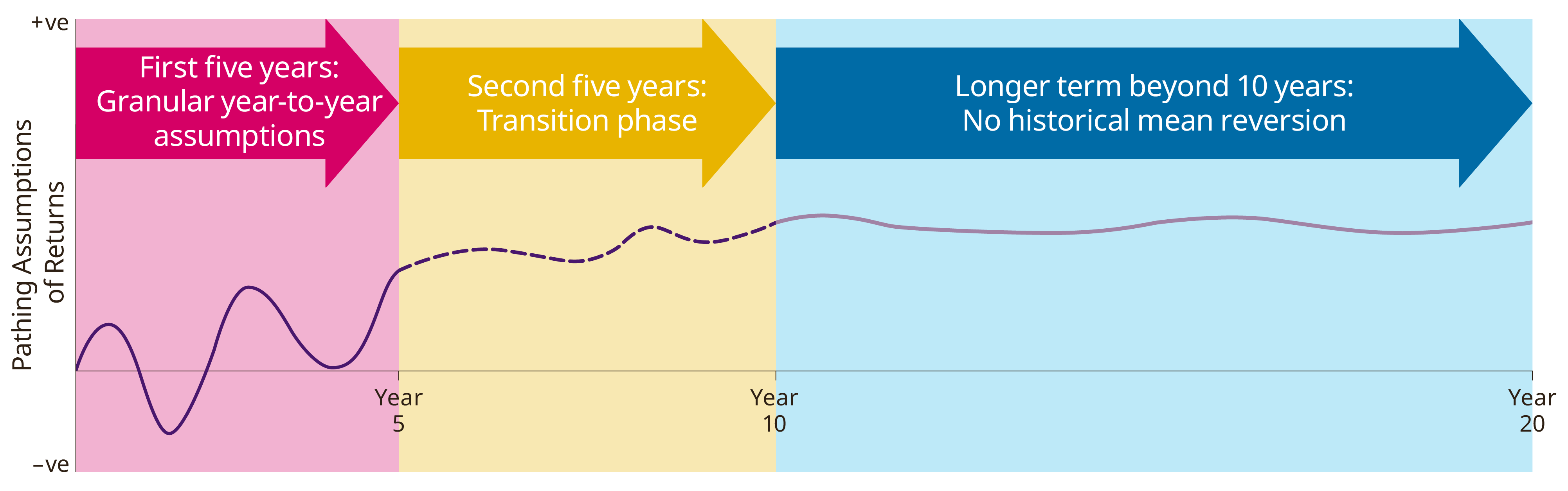

In projecting economic fundamentals, we make more granular year-to-year assumptions for the first five years, and transit to more general assumptions based on longer term fundamentals as we go beyond 10 years. This “pathing” approach incorporates assumptions about changes in economic conditions over time. We do not assume an equilibrium return that remains unchanged over the 20-year period, nor do we assume a reversion to the historical mean.

Economic Scenario Pathing (Illustrative)

20-year Expected Returns for Different Portfolio Mix

The charts below show the simulated returns for a Global Bond Portfolio, a Global Equity Portfolio and the Temasek Portfolio. The simulations are based on our Central Scenario.

The Global Bond Portfolio has the lowest upside potential, as compared to the Global Equity and Temasek Portfolios. It also has the least volatility, as shown by its narrower year-to-year annual returns distribution curve.

The Temasek Portfolio has the highest upside potential (see blue shaded) at the end of the 20-year period, but also the highest volatility.

(as at 31 March 2018)

Likelihood of Geometric Returns (Compounded Annualised) at the End of 20-year Period, by Portfolio Mix

(as at 31 March 2018)

Likelihood of Year-to-year Annual Returns during 20-year Period, by Portfolio Mix

Temasek’s 20-year Expected Returns for Various Potential Scenarios

We also simulate our 20-year expected returns under different scenarios.

Potential Scenarios for 2018 and Beyond

| Potential Scenarios | Description |

|---|---|

| Central | Our baseline expectations of growth, reflecting our views of the most likely economic pathway. |

| China Credit | A sharper than anticipated slowdown in growth, as reforms prove too slow to rebalance the economy and address corporate debt-related vulnerabilities. This is a less likely alternate scenario. |

| Global Trade War | Significant increase in trade conflicts amongst major economies, with substantial escalation in barriers to global trade such as tariffs and retaliatory measures. This is a less likely alternate scenario. |

| US Monetary Shock | US Federal Reserve underestimates the run-up in inflation pressures and loses control over the inflation anchor, forcing it to raise rates faster in response. This is a less likely alternate scenario. |

The T-GEM 20-year returns curves for the Temasek Portfolio are shown below for the Central, China Credit, Global Trade War, and US Monetary Shock Scenarios.

The Central Scenario offers the highest expected 20-year returns, compared to those under three alternate scenarios of China Credit, Global Trade War and US Monetary Shock Scenarios. It also has slightly less volatility in the annual returns in any single year during the 20-year period.

(as at 31 March 2018)

Likelihood of Geometric Returns (Compounded Annualised) at the End of 20-year Period, by Potential Scenario

(as at 31 March 2018)