Jump to

Related Content

Our Temasek Review, Credit Profile and Temasek Bonds serve as public markers to anchor our commitment as a robust and disciplined institution through generations.

Public Markers

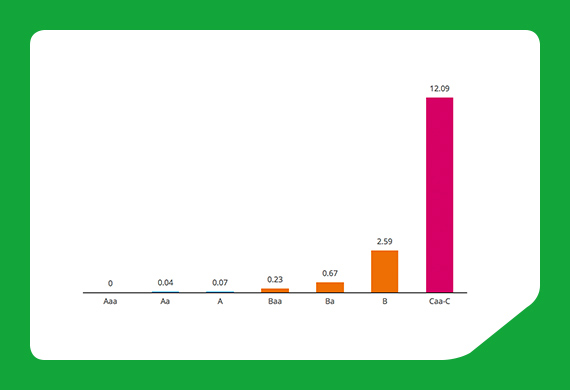

Read moreAll investments carry risks. Investors need to understand the risks and balance them against their desire to earn higher returns.

Investing in Bonds

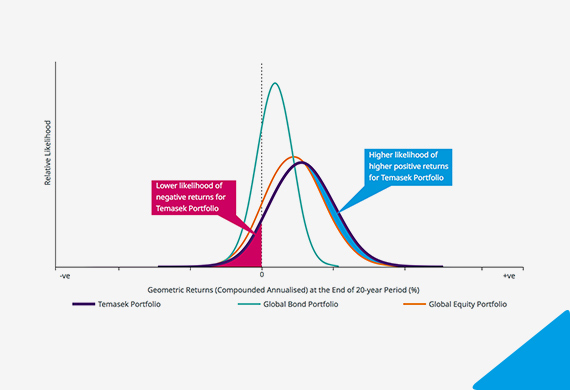

Read moreUsing a scenario-based approach, we simulate the range of possible returns for our portfolio over the next 20 years.