Jump to

Managing Risk

There are inherent risks whenever we invest, divest, or hold our assets, and wherever we operate.

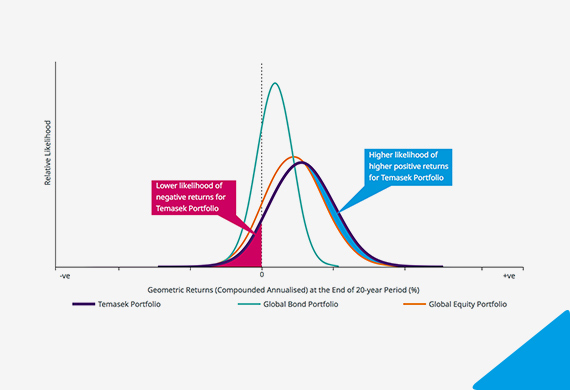

We adopt a long investment horizon, with the flexibility to take concentrated positions. We invest across all stages of a business life cycle, from early stage and unlisted, to large or listed assets. We do not have predefined concentration limits, or targets for investing by asset class, country, sector, theme or single name.

Our long investment horizon means we have a portfolio of mostly equities, including unlisted assets such as private equity funds, to deliver higher expected risk-adjusted returns for the long term.

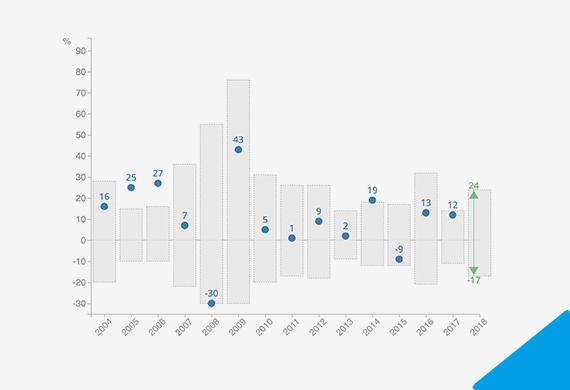

Consequently, our portfolio is expected to have higher year-to-year volatility of annual returns, with higher risks of negative returns in any one year.

Our investment posture is to ride out such short term market volatility, and focus on generating sustainable long term returns. We do not manage our portfolio to short term mark to market losses.

Given the expected year-to-year volatility, we manage our leverage and liquidity prudently for resilience and investment flexibility, even in times of extreme stress.

We adopt a long investment horizon, with the flexibility to take concentrated positions.

Our investment posture is coupled with a culture of risk awareness and balanced risk taking. This applies to both our investment activities and institutional capabilities. Our risk sharing compensation philosophy puts the institution above the individual, emphasises long term over short term, and aligns the interests of our staff with those of our shareholder.

We have no tolerance for risks that could damage the reputation and credibility of Temasek.

Organisational Risk Management Framework

Our Organisational Risk Management Framework includes Risk Return Appetite Statements (RRAS) which set out various levels of risks tolerance, from reputational risk, to liquidity risk and sustained loss of overall portfolio value over prolonged periods.

| RRAS 1 | We have no tolerance for risks that could damage Temasek’s reputation and credibility |

|---|---|

| RRAS 2 | We focus on performance over the long term |

| RRAS 3 | We have flexibility to take concentrated positions |

| RRAS 4 | We maintain a resilient balance sheet |

| RRAS 5 | We evaluate the potential for sustained loss of overall portfolio value over prolonged periods and use different scenarios to test our resilience |

We track and manage risks proactively, and through economic and market cycles, including specific risks at asset level.

To minimise operational risks, we embed risk management in our systems and processes. These include our approval authority delegation, company policies, standard operating procedures and risk reporting to our Board.

Formalised processes instil the discipline to consider various perspectives. Investment proposals to our investment committee are submitted under a two-key system, for instance by both market and sector teams. Depending on the size or risk significance, these proposals may be escalated to our Executive Committee or Board for final decision. Functional teams provide additional specialist perspectives and independent reviews.

We consider environmental, social and governance factors, alongside other issues and risks, when we make decisions as an investor, institution and steward. Country and sector risks are factored into our risk-adjusted cost of capital for each investment. We safeguard our investments by adopting valuation discipline.

We assess the potential sustained loss for our overall portfolio value, under various stress scenarios driven by significant event risks.

For each scenario, we estimate the sustained impact on the intrinsic values of individual investments, in comparison with their original investment theses. The aggregate of these estimated sustained impact forms our view of the potential sustained loss of our overall portfolio value.

As illustrated in the diagram, the fundamental earnings impact is a sustained loss. This is different from the trough impact, which includes mark to market effect due to shorter term increases in risk aversion. We manage our portfolio based on the sustained impact on intrinsic value, not the short term mark to market impact.

We track and manage risks proactively, and through economic and market cycles, including specific risks at asset level.

Illustration of Fundamental Earnings Impact

Based on our assessments of any likely sustained loss, we may manage the risk as follows:

- Divest, hold or protect the individual investment impacted;

- Change the portfolio composition for the long run;

- Take actions to protect the portfolio;

- Mitigate the risks.

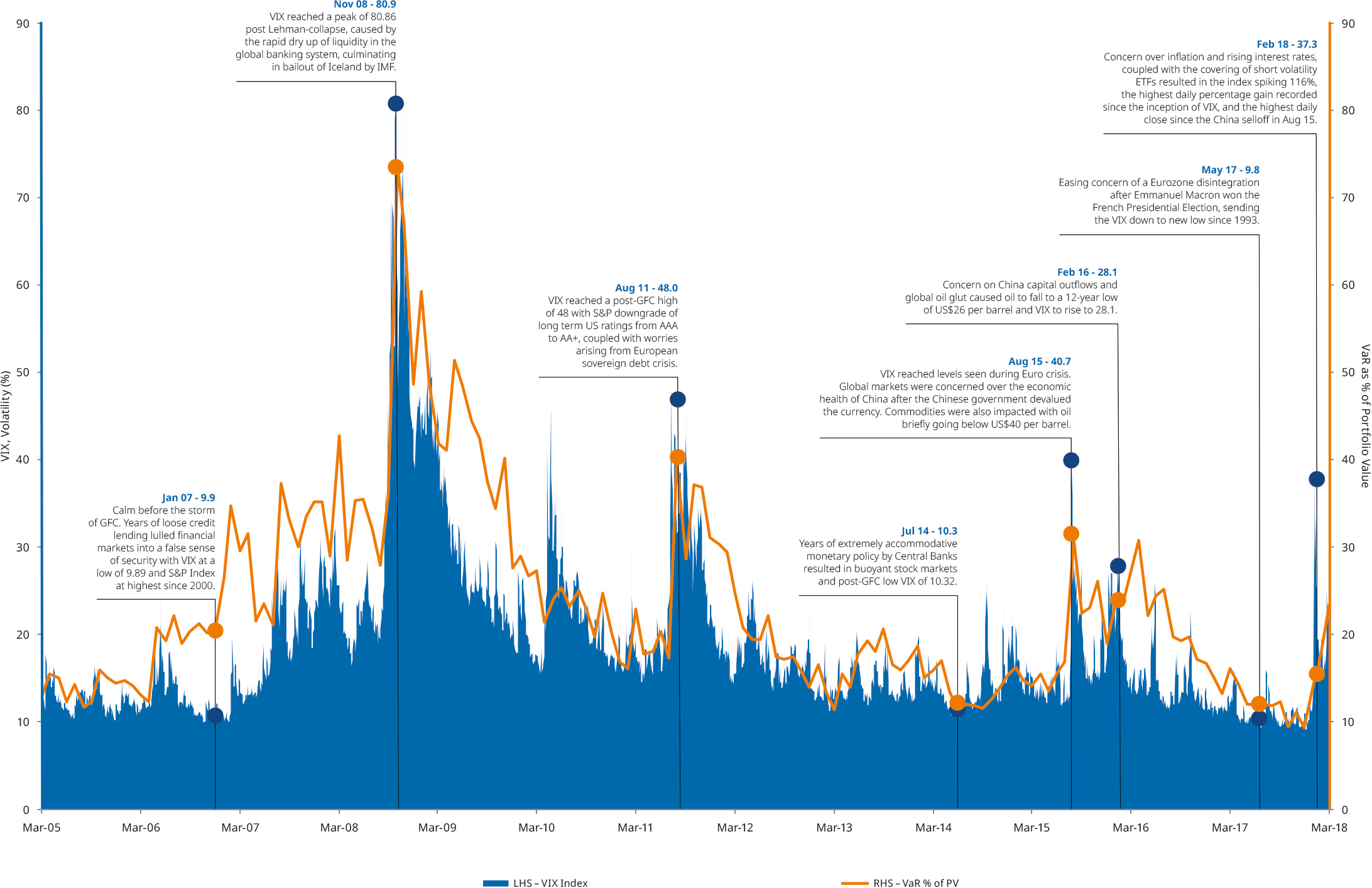

In addition to scenario-based stress tests, we track Value at Risk (VaR) and Stress VaR to provide a sense of the volatility of our portfolio value in the short term. We also monitor general market risk indicators such as the CBOE Volatility Index (VIX).

VIX Trend and Temasek’s VaR as % of Portfolio Value (March 2005 to March 2018)

Concentration Profile

Temasek has the flexibility to take concentrated stakes in investments in anticipation of better returns. Our portfolio profile is the result of our investments in aggregate. For the year ended 31 March 2018, our top 10 holdings represented 41% of our total net portfolio value.

Our largest geographic concentration by underlying assets remains in Asia, with 27% and 26% in Singapore and China respectively as at 31 March 2018. The US is third largest at 13%, followed by Europe at 9%. The growth of exposure to US and Europe reflects the growing investment opportunities in the relevant focus areas over the last seven years.

We have the flexibility to take concentrated stakes in investments in anticipation of better returns.

The financial services sector remains our largest sector concentration as at 31 March 2018, at 26% of our total portfolio, up from 25% a year ago.

Singtel remains our largest single name concentration at 9% of our portfolio in March 2018, down from 18% in March 2008, and 46% in 1998, largely due to the growth of our portfolio.

Legal & Regulatory

We comply with all obligations under Singapore laws and regulations, including those arising from international treaties and UN sanctions. We comply with the laws and regulations of jurisdictions where we have investments or operations.

Our global footprint, coupled with an evolving legal and regulatory environment and increasing oversight by authorities, underscores the importance of robust compliance programmes. Our Legal & Regulatory department (LR) ensures that policies, processes and systems are appropriately designed, consistent with applicable laws, and aligned with Board directives. For instance, our policy on derivative transactions permits only personnel authorised by a board resolution to enter into such transactions within tightly defined scopes and limits on behalf of specific designated entities. LR also provides regular education and training on key policies and processes.

We comply with the laws and regulations of jurisdictions where we have investments or operations.

LR monitors regulatory reporting compliance through robust securities tracking systems. Regulatory requirements and monitoring systems are continually reviewed and updated to track changes in laws and regulations.

Our Temasek Code of Ethics and Conduct (T-Code) and its related policies guide our Board directors and staff in their daily dealings and conduct. With integrity as a key overarching principle, T-Code policies cover areas such as anti-bribery, whistle-blowing, management of confidential information, and prohibition against insider trading. Our annual staff bonus plans include T-Code compliance requirements.

Our policy permits only personnel authorised by a board resolution to enter into derivatives transactions within tightly defined scopes and limits.

Business Continuity and Incident Management

Our contingency management framework ensures business continuity, and shapes our responses to potential incidents arising from safety, physical and cyber security and other threats. We are committed to continually improve the way we manage business continuity risks. This takes into account potential emerging risks, or new responses enabled by new technologies or capabilities.

We conduct response exercises, including full data centre recovery, on a regular basis to ensure that they remain effective, relevant and adequate. We maintain a hot site where key staff can continue to operate in the event of emergencies.

We care for the safety, security and well-being of our staff and their families during emergencies. We are part of the Business Psychological Resilience Programme (B-PREP) organised by Temasek Foundation Cares, alongside nine other Temasek portfolio companies, to enhance emotional resilience against major crises or accidents.

We provide necessary assistance to our staff wherever they operate and support communities in disaster-affected areas where we can be helpful. This included providing AIR+ smart masks and micro fans to relief workers and residents in the aftermath of the Mount Agung and Mount Sinabung eruptions in Bali in early 2018.